A Draft Proposal for a Generic Gas-to-Liquids (GTL) Project with Co-Production for the Northern Territory, Australia: Technical Notes Summary

Document No. GTL-NT-04/1

Jake W. De Boer, MEng, BCom

Principal Consultant , HCP

Dr. Michael C. Clarke, CPEng, FIEAust, MAusIMM, RPEQ

Director, Pacific Power Partners LLC

.

SUBJECT: This Technical Note provides an initial assessment of a generic GTL with co-production of both base load and peak power. A tentative location is for the Darwin region, Northern Territory, Australia.

HOLT CAMPBELL PAYTON Pty. Ltd.

Consulting Mechanical Engineers _ Level 10, 5 Mill Street Perth WA

PACIFIC POWER PARTNERS LLC

205 West 17th St., Suite E, Tulsa Ok. USA 74119-4645

M.E.T.T.S. Pty. Ltd.

Suite 1, 30 Barker St. New Farm, Queensland, Australia 4005

TABLE OF CONTENTS

1. INTRODUCTION

SUMMARISED (UN-LEVERAGED) ECONOMICS

2. APPROACH

TECHNOLOGY BASIS

ENVIRONMENTAL CONSIDERATIONS

NORTHERN TERRITORY'S GAS RESERVES

PRODUCTION TECHNOLOGY

REFORMING GAS-TO-LIQUID CONVERSION

TECHNOLOGY VARIANTS

FEEDSTOCK SELECTION

CONCEPT

3. PROPOSAL

SOME FIGURES

PRODUCT MIX

THE WAY FORWARD

FEASIBILITY STUDY, SCOPE & COSTING

4. CONTACTS

INTRODUCTION

Pacific Power Partners LLC, currently is investigating the potential opportunities for a significant energy/petrochemical development for The Northern Territory, Australia.

It is:

The Development of a Gas-to-Liquids Plant for utilising some of Australia's Natural Ga Reserves.

Further:

Pacific Power Partners (PPP), LLC, has had an agreement to market an advanced Gas-to-Liquids (Fischer-Tropsch) Technology, that can be applied to stranded and associated natural gas reserves.

It can offer Australia import replacement for liquid fuels and a source of superior lubricants. It will help provide the nation with liquid fuel security following the exhaustion of the Bass Strait resource.

This preliminary analysis reviews a plausible GTL layout with target of ~55,000 bbl/d of F-T liquid fuels, and associated power generation. A competitive (generic) iron-based Fischer-Tropsch catalyst has been assumed, which is believed to be better suited to co-production of power.

1.1 Summarised (un-leveraged) economics:

Capex (indicative for tropical site near harbour) $2200m

Key assumptions:

- all US$, instantaneous Q1/2004

- average crude oil price $21/bbl fob Dubai

- average FT diesel premium +$5/bbl = $31.5/bbl netback

- average lube oil netback $70/bbl

- average power value $30/MWh ($60/MWh - peak)

- NG contains 5% NGL's, cost $0.9/GJ

Sales $715m/a

(55 000 bbl/d of diesel, naphtha, lubes, LPG;

425MWe of base-load power, with peak power

estimated at 200 MWe, for four hours per day)

Less Cost of production $259m/a

Cash flow (pre tax) $456m/a

Simple ROI% 21%

Overall Carbon efficiency 76%

This summary demonstrates potential for an above average utility investment, which has a low market risk, and provides a platform for additional economic growth.

2. APPROACH

2.1 Technology Basis 2.1.1 History: Born of need for energy security Fischer-Tropsch (F-T) technology originated from the 1920's, and was used specifically by Germany and also Japan to augment liquid transportation fuel during the Second World War. Post war saw South Africa commercialise coal based F-T technology to broaden energy security. This also formed the basis for a novel (base) petrochemical industry in the country. Following initial government support, the Sasol company was privatised and is demonstrating commercial success with an annual turnover of over US$6000m and an annual operating profit of ~US$1000m. By the 1990s, two gas based (GTL) F-T plants had been constructed (Shell in Malaysia ~ 12,000 bbls/day, Mossgas (Sasol) ~ 180,000 bbls/day in South Africa), demonstrating that F-T technology is a viable process to produc liquid transportation fuels. 2.1.2 An environmental and NG driven Renaissance In the past 10 years F-T technology has now gained new interest due to the need for cost effective advanced lubricants for modern engines, and very clean (essentially sulphur and aromatic free) liquid fuel, that they can produce, which significantly improves vehicle tail pipe emissions. See below:

Source: Shell: http://www.energy.ca.gov/afvs/synthetic_diesel.html

Cleaner transportation fuels will contribute to lower emissions from combustion engines, reducing emissions of sulphuric acids, sulphur dioxide, nitrogen oxides, and metal oxides. (See Diagram below - Source: Sasol)

2.1.3 The Northern Territory's Gas reserves and their proposed usage.

Australia has very significant natural gas reserves. These reserves, although not fully proven, stand at over 150 Trillion Cubic Feet (TCF). The Northern Territory has access to around 20-30 TCF of reserves, most of which are located off-shore from Darwin. The GTL plant would require around 500 million cu ft of gas per day. For a reserve of 5 - 6 TCF (equal to 5000 - 6000 PJ), and given a 340 day production year, product would be produced for around 30 years.

2.1.4 Production technology

Synfuels from natural gas can be produced in a two step process: reforming the feed gas and thence gas-to-liquid synthesis.

2.1.4.1 Reforming:

"Reforming" is the term used to convert the hydrocarbon feedstock (methane) to synthesis gas (syngas), which comprises are chiefly hydrogen (H2) and carbon monoxide (CO), usually with traces of carbon dioxide (CO2), inerts (such as nitrogen (N2) and Argon) and un-reacted methane.

F-T has a preference for a syngas ratio of H2:CO of around 2:1. Sulphur components are removed by scrubbing and recovered for sale; the F-T catalyst is sensitive to particularly Sulphur poisoning.

There are four reforming processes for turning natural gas into syngas. We have chosen the POX (partial oxidation) which involves "burning" methane in an oxygen deficient atmosphere (reactor), which generates syngas. The POX technology uses high purity oxygen, generated with an ASU (air separation unit). This technology provides a near 2:1 H2/CO syngas, which is very appropriate for the intended conversion step. NB Shell uses POX for their Malaysian GTL plant.

The reforming reaction is thus:

CH4 + 0.5 O2 ---> CO + 2H2 + Heat

2.1.4.2 Synthesis:

This involves the Fischer-Tropsch synthesis where syngas is converted to longer hydrocarbon chains, with co-production of water.

xCO + yH2 ----------> z(-C H-) + n H20 + off-gas + Heat

......................Catalyst

z(-C H-) includes products such as naphtha, diesel fuel and petroleum waxes.

(-C H-) will be mixtures of olefines and paraffins

The extent of chain length (ie the product mix) is a function of the F-T catalyst, and reactor conditions. The current view is maximising (paraffinic) wax production, which can be hydrocracked to lube oil and high quality middle distillate (diesel). This favours a FT reactor operating at ~250°C and ~30bar.

The catalyst can be based on Cobalt, Iron or Ruthenium, with promoters. Iron unlike cobalt and ruthenium, induces the shift reaction equilibrium, which limits conversion per pass. Iron is however low cost, and most importantly, environmentally benign.

2.1.5 Technology Variants

Various companies have proposed GTL technology: Sasol, Shell, Exxon, Rentech, Syntroleum, BP, Conoco and others have GTL processes in various stages of development.

Only Sasol (>180 000 bbl/d) & Shell (12 000 bbl/d) have operated commercial scale plants over several years. Other players generally are limited to pilot plant exposure in the order of ~100-300 bbl/d. From the above, PPP is favouring the Sasol process, because of its commercial track record and experience with various potential co-products such as waxes and olefins.

2.1.6 Feedstock Selection

For this proposal PPP is concentrating is efforts in looking at syngas produced from methane. The literature indicates a preferred scale should be ~50 000 bbl/d and upward. This suggests an ideal gas resource would be ~5 TCF (trillion {1012 } cubic feet), which would ensure a 30 year plant life.

The Northern Territory with its uncommitted offshore reserves, is sited in a region that is not currently attractive for major reticulation to a large metropolis or general industry, and where the economics of using it only for power generation are not good. NG typically contains some percentage of NGLs (natural gas liquids), which can be combined with the GTL LPG and naphtha (minor sulphur content not an issue for these products). The value-adding nature of the GTL-power complex will provide better returns than 'quarrying' the gas for sale as LNG, as well as a greater in-country economic stimulation and opportunity.

2.1.7 The Concept

To maximise the use of the energy contained in the natural gas feed, PPP are proposing the creation of a petrochemical and power complex. The complex will offer:

- product diversification and flexibility,

- high energy efficiency,

- good environmental performance,

- generate significant baseload (425 MWe) and peaking power (200 MWe), waste heat for co-production (as hot water), and high quality by-product water, and

- potential for a range of petrochemical products, with Fischer-Tropsch diesel being the (initial) major output.

For the Territory and Australia the total benefit for best utilising the Territory's gas reserves would be much bigger than the returns from a GTL plant alone. Many synergies and opportunities would be created by the landing of natural gas from the Bonaparte basin in the Darwin region, and processing a significant portion of that gas into liquid petroleum.

The first synergy, is the operation of the LNG plant (presently under construction) in parallel with the GTL plant. Because the liquefying of natural gas requires extreme cold (cryogenics), the separation of air into oxygen and nitrogen for the GTL could be accomplished in the same plant. The cold nitrogen, that would not be used in either the LNG or GTL plants, could be utilised by the Territory's export frozen meat and livestock industry.

The second synergy, is that the natural gas from the central Australian gas fields near Alice Springs, is rapidly running out. By reversing the flow of gas in the Darwin-Alice pipeline, then Alice and the customers along the existing pipeline could be supplied with gas for a very long time. This would provide the Territory's mines and other users of gas with energy security on which to base their continued existence and allow for future expansion.

The most significant synergies and opportunities however exist for the export of liquid petroleum product from the Territory. The ultra clean diesel and LPG could be directly shipped to southern markets by the Darwin-Adelaide railway. The naphtha and lubricant feedstocks could either be shipped to Singapore or to Eastern Australian refineries for further processing. Likewise petroleum condensate from the gas processing plants could be combined with the GTL naphtha, and be shipped to Singapore or to Eastern Australian refineries. (Note. If the volumes of petroleum throughput were sufficient, then a refinery attached to the GTL plant in the Darwin region would be an option.)

A scheme that is being explored is a GLT plant that will produce fifty five thousand barrels of petroleum per day when fully constructed. The plant would be built in three production trains with each train capable of producing 150 MW of electrical energy as a by-product. The total plant would also produce approximately sixty thousand barrels of clean water per day. Given the Territory's present power generation capacity of around 400 MW, the phased in supply of 425 MW from the GTL plant would allow for growth in supply, as well as the phasing out of some of the more expensive existing power plants. Since the power supplied from the GTL plant would be a by-product, and would be generated from waste heat and the use of waste process gas from the plant, the price of power supplied to the Territory's Power and Water Authority would be reduced, and thus cheaper power should be available to domestic, commercial and industrial customers.

3.0 PROPOSAL

3.1 Some Figures

A 55 000 bbl/day plant (with power export) would require around 500 million cu ft of gas per day. For a reserve of 5-6 TCF, and given a 340 day production year, product would be produced for around 30 years. For analysis the NG is assumed to contain 6% NGLs, which are recovered together with the GTL product.

Plant costs are estimated at around $US 2200m for a 55,000 bbl/day plant, which assumes a tropical coastal location, with harbour access, and excludes the gas resource owners costs, site infrastructure and urban development.

3.1.1 Product mix

The base plant is intended to produce 5 products, these being: Diesel, Synlube basestock, Naphtha, LPG and Power Exports. Synlube oil base stock is considered an important product.

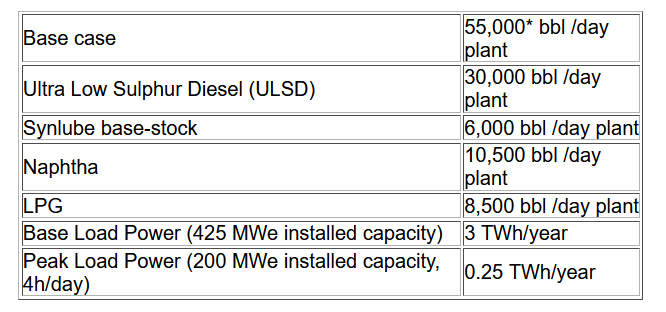

The Table below gives the indicative product mix:

*This excludes recovery of some NGL's from the NG feed.

For the (initial) analysis the following pricing is assumed:

Diesel

The diesel produced is environmentally superior to conventional refined diesel products and should command a premium. The GTL diesel could either be used "neat" (on its own) or blended to upgrade inferior grade refinery diesel. We would expect a $5+ per barrel premium, in line with ULSD (ultra low sulfur diesel) pricing. GTL diesel net-back has been calculated at $31.5/bbl.

Synlube Basestock

Hydroisomerised FT wax can be used to produce a high quality, high viscosity index PAO (polyalphaolefin) lube oil substitute. The assumed net-back is $70/bbl, with a production capacity of ~6,600 bbl/d.(Note: The plant could produce considerably more lubes, but is likely to be market development constrained)

Naphtha

The GTL naphtha is predominantly paraffinic and makes an excellent feedstock for ethylene production - enhancing ethylene and propylene yields for the same cracking severity. There are various smaller naphtha crackers in SE Asia, which could use the naphtha. It is a low octane fuel blending component - with favoured use outside petrol. It could also be utilised in power generation in single or combined cycle plant, or a spark ignition generation-set(s).

The NGL naphtha fraction is combined with GTL naphtha. The specific situation will determine the destination of the naphtha product. A net-back of $25/bbl has been assumed.

LPG

The LPG includes both the NGL and GTL derived LPG. A regional market is preferred. A net-back of $21/bbl has been assumed.

Power

The plant is configured for a net anticipated 425MWe power export, which requires a regional market. This output is a sensible base load. A value of $A40/MWh has been assumed. (Note: $ US 30/MWh is an attractive international cost for power.).

In addition an extended peaking power plant would be configured in a "parallel" manner; that is, the syngas could be allocated to either of the two plants based on power demand. During periods low power demand, more syngas would be diverted to the GTL plant (and visa versa); if there is no demand for outside power, the GTL plant would use more of the available syngas except for that needed the generate electricity for internal plant/refinery use.

A further supplement for peak power demand is burning LPG. LPG provides stored on site "power". Peak power is valued at $A80/MWh. This combination of exploiting synergy between GTL fuels and power flexibility is likely to offer both enhanced efficiency and economics.

Other products

A GTL complex could provide the lever for other petrochemicals and derivatives that

build on the created infrastructure. E.g.

- Waxes

- Paraffins and solvents

- Other syngas derivatives

- Low echelon heat (for drying)

- Water recovered (the target being a water neutral GTL petrochemicals complex?)

3.2 The Way Forward

3.2.1 A Concise and Exhaustive Feasibility study

A full blown Feasibility Study will be required to establish the particular economics of building a GTL/power plant. The Feasibility Study will focus on two specific aspects:

(1) a Technical study including an EIA, and

(2) a Business Plan.

The Technical study encompasses choice and technology selection, process layout, preliminary site plan, preliminary process flows, an environmental impact assessment, an initial environmental management plan, a social impact assessment and products targeted, plus capex and opex estimates.

The Business plan includes a marketing plan, project economics, leveraging, financing, risk analysis and political support and partnering.

The cost feasibility of the feasibility plan (a bankable document) is estimated at between $A 0.75 - $A 1.25m, with the difference being the contribution of work-in-kind from equipment vendors.

3.2.2 The creation of a project team to plan, finance, manage, construct and commission the project.

4.0 CONTACTS

This document was produced by:

Mr. Jake W. De Boer, of HOLT CAMPBELL PAYTON Pty. Ltd. , Consulting Mechanical Engineers, Level 10, 5 Mill Street Perth WA.

Email: hcp[at]hcp.com.au

and

Mr. Tom Warlick, of Pacific Power Partners, Infrastructure Consultants, Tulsa, Ok. USA & Dr. Michael C. Clarke, M.E.T.T.S. Pty. Ltd., Consulting Infrastructure Development and Resource Management Engineers, Brisbane, Queensland.

Email: pacificpower [at] webzone.net AND metts [at] metts.com.au

Disclaimer

The Technical Note that forms the basis of this summary has been prepared on behalf of and for the exclusive use of Pacific Power Partners LLC and is subject to and issued in accordance with a standard agreement between Pacific Power Partners and Holt Campbell Payton Pty Ltd.

Holt Campbell Payton Pty Ltd, Pacific Power Partners LLC (PPP) and M.E.T.T.S. Pty. Ltd. accepts no liability or responsibility whatsoever in respect of any use of or reliance upon this report by any third party.

Pacific Power Partners LLC (PPP)/M.E.T.T.S. Pty. Ltd. offers this summary of the Technical Note for public discussion. Any quotes or reference to this summary must be accompanied by an acknowledgement to Holt Campbell Payton Pty Ltd and Pacific Power Partners LLC/M.E.T.T.S. Pty. Ltd., and the authors, Jake W. De Boer and Michael C. Clarke.

NOTE:

You are welcome to quote up to a maximum of three paragraphs from the above article, on condition that you include attribution to this website, as follows:

SOURCE: M.E.T.T.S. Pty. Ltd. Website https://www.metts.com.au